RV Insurance

RV Insurance Coverage Most Recreational Vehicles – RVs for short – fall under Alabama’s Mandatory Liability Insurance Law. So, if your RV is a motorized vehicle, you must comply with the...

Commercial Auto Insurance

Who needs commercial auto insurance? It’s estimated that one in four workplace deaths are due to motor vehicle accidents. Are you a business owner who uses one or more vehicles during the course of...

Cyber Liability Insurance

Cyber Liability Insurance and Data Breaches Attention business owners! A reminder: As of May 1, 2014, the Alabama Insurance Services Office requires agents handling comprehensive business insurance...

Car Color and Car Insurance

Car Color and Car Insurance-Does Color Count? You have saved your hard earned money for months. You have searched Google, test driven, pondered, watched Facebook, checked Carfaxed, and now you’re...

5 Reasons to Say “Yes” to Uninsured Motorist Coverage

Uninsured Motorist Coverage Many states, including Alabama, require drivers to carry Uninsured Motorist Bodily Injury Insurance. Well, kinda, Uninsured Motorist Accident sorta require it. Though...

3 Reasons to Consider Renters Insurance

Why you should consider Renters Insurance? Do you carry Renters Insurance? Are you an apartment renter? Do you rent a condo or someone’s house? If so, keep in mind that while you don’t necessarily...

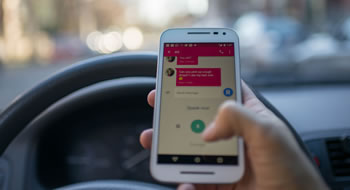

Distracted Driving is Dangerous!

Distracted driving is a very dangerous and all too common behavior on the roads today. You can be a part of the solution to this deadly problem by putting your phone away in the driver's seat and...

Is Life Insurance Really Worth It?

Life Insurance.... What's in it For Me? Why would someone consider buying life insurance and what kind is the best policy for their dollar? Life insurance is one of the foundations of managing your...

Look Out! Deer!

Avoiding a Deer / Car Collision Here in Alabama, we more or less take it for granted that there will be deer on the roadside. Over the years however, there has been a steady increase in deer-car...

All Boat Insurance Is Not The Same

Comprehensive Boat Coverage In general, boat insurance will cover you for loss or damage to your boat. In most cases it covers watercraft with motors, such as fishing boats, pontoon boats, paddle...

Deductibles – High or Low?

Which is The Better Choice for Auto Insurance: High Deductible or Low Deductible? A very common question we hear is "Is it better to have a higher deductible on my car insurance than a lower...

Backyard Pool Safety Guidelines

The Fun Of A Backyard Pool Has Hazards Too! Enjoying a backyard pool is an incredible experience, but there is a lot of responsibility that goes with owning one. Follow the suggestions below on...

Is it Possible to Fund Your Retirement & Your Children’s College Too?

It Isn't Uncommon to See People Cheat Their Own Retirement Plan to Provide For Their Kid's College Fund. Focusing on children’s college tuition needs and neglecting their own retirement is something...

Tips for Hiring a Contractor For Home Renovation

Hire the Right Contractor for Your Home Renovation Job. When you are planning a home renovation or improvement project, you should be aware that your contractor choice can be a critical part of the...

Five Tips To Protect Your Possessions

You might think a standard homeowners policy provides coverage for all your valuables, but most policies provide limited or no coverage for certain items — sometimes expensive ones. If something...

Who Needs Renters Insurance?

Often renters don't realize how beneficial an insurance policy that protects their valuables in a catastrophe such as fire or theft. It is a huge mistake to assume that damage or loss of your...

Insuring Your Home to Its Replacement Cost

If something catastrophic happened to your home (fire, tornado), would your insurance policy be enough to cover the cost of rebuilding it? If your home is not insured up to its full replacement...

Identity Theft Advice

Tips to Help You Avoid Becoming a Victim of Identity Theft A victim of Identity theft can spend many months and sometimes years correcting the damage done by fraud caused by the theft of...

Do Home Security Systems Reduce Homeowners Insurance Costs?

A home security system could make as much as a twenty percent reduction in cost on your homeowners insurance. Having a monitored security system installed can make your home and property safer and...

Crazy Things Your Home Insurance Probably Covers

Here are 15 Events You Probably Didn't Know Your Homeowners Insurance Policy Covers! Most people don't read their entire homeowner's insurance policy, assuming that all policies are the same and...

Insurance Riders – Do You Need Them?

Insurance Helps to Mitigate The Impact on Your Family, Should You Become Unable to Provide For Them in Your Normal Capacity. Insurance Riders Can Tailor Your Policy to Better Serve This Purpose....

How Much Homeowners Insurance Do You Need?

How Much Homeowners Insurance is Too Much? How Much is Enough? If you are preparing to buy a home you should know that you'll need adequate insurance to cover the house and all your belongings in...

8 Tips to Get Life Insurance Coverage That Meets Your Needs & Budget

Life Insurance is a Vital Part of Family Financial Stability. Like a Lot of People, Shopping For Coverage May Make You Feel Stressed. Here Are 8 Tips to Help You! Having a relationship with your...

7 Things You Probably Don’t Know About Homeowners Insurance

Auto-Owners Insurance is one of our excellent insurance carriers. They have written up an excellent informational article about homeowners insurance and some things about it that you might not have...

Should You Package or Bundle Your Insurance Policies?

Every person, Every Family and Every Business is Unique, so Whether or Not To Bundle Insurance Policies is Not Always Obvious. Top 3 Reasons to Package or Bundle Policies Potential Big Savings It's...

Furnace Coverage, Inspection & Maintenance

If Something Goes Wrong With Your Furnace, It Could Cause Quite a Bit of Damage Without Furnace Coverage. So Ask Yourself This Question: "Does My Standard Homeowners Insurance Policy Include Furnace...